The importance of creating a draft budget in project planning and management is emphasized in this section. Techniques for clarifying budget items and estimating costs accurately are discussed, along with identifying potential sources of funding. Learners gain insights into developing a summary of estimated costs to inform budget planning and resource allocation decisions.

Learning Objectives:

- Understand the importance of creating a draft budget in project planning and management.

- Learn techniques for clarifying budget items and estimating costs accurately.

- Identify potential sources of funding and develop a summary of estimated costs to inform budget planning and resource allocation.

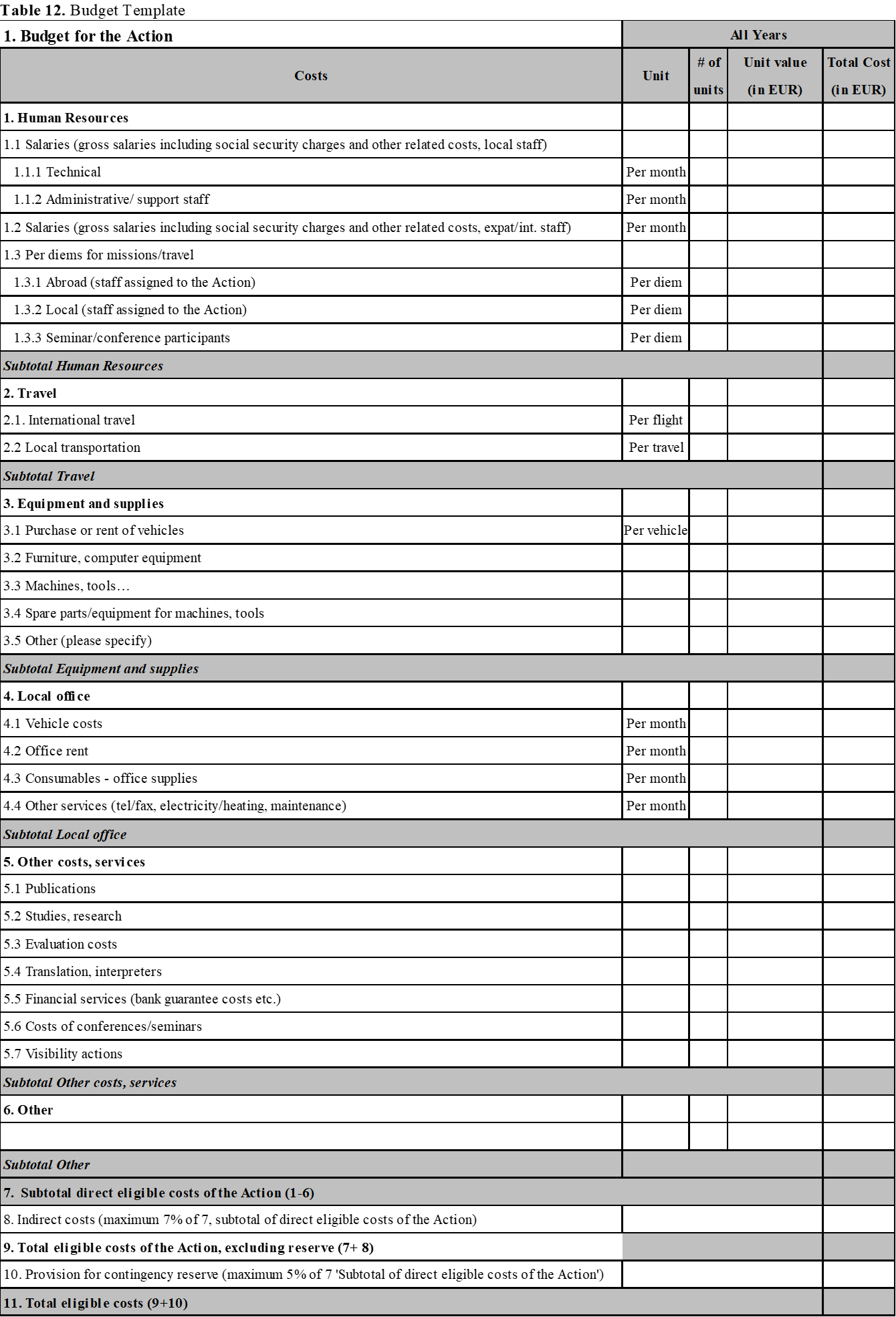

Budgeting is one of the most important part of a Project proposal. Costs that you will determine should be in line with the activities which have to produce benefits, good quality and lead your Project to its goals.

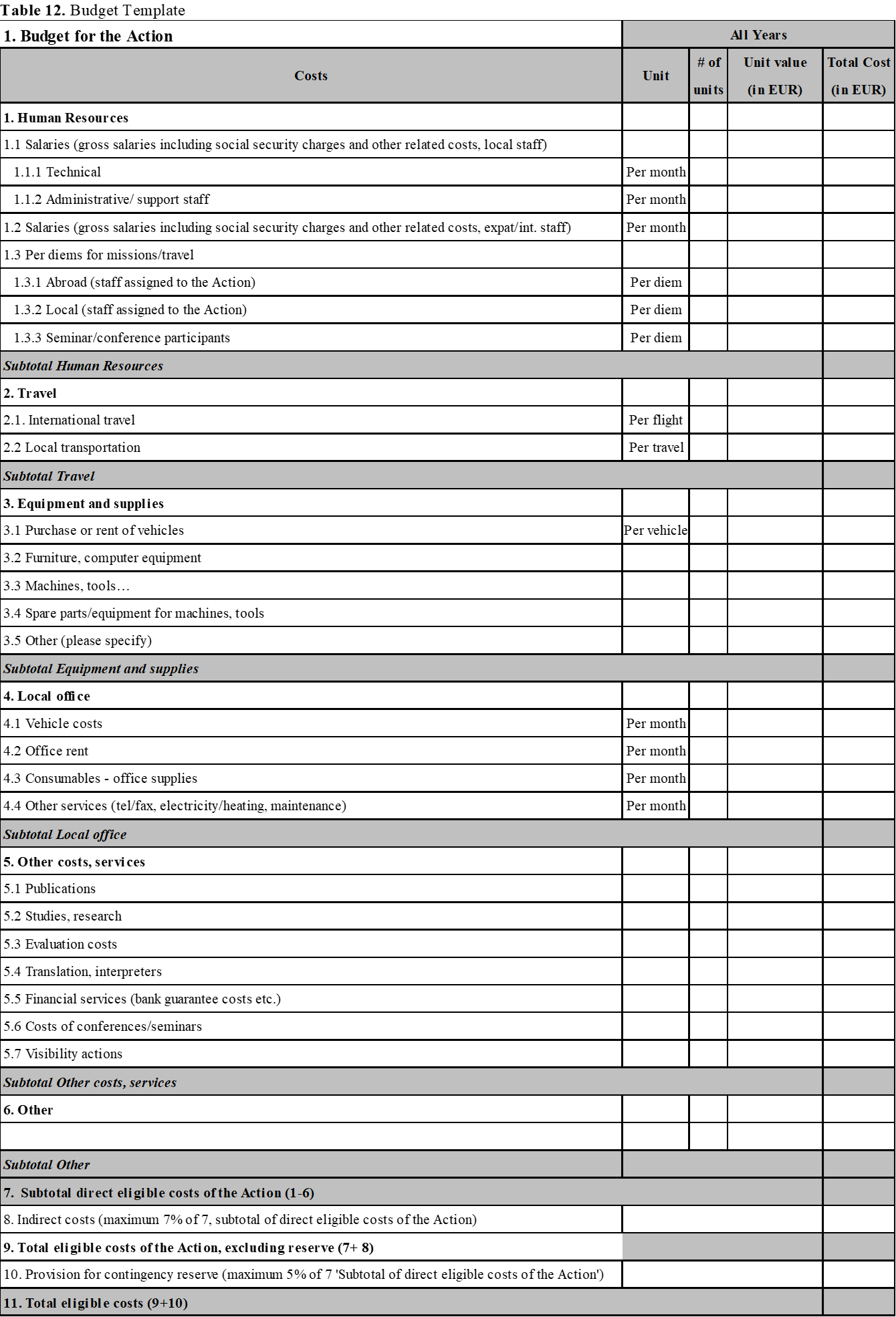

Below is a budget template used by the European Union:

In the previous sections, it was mentioned that you should note the necessary resources and equipment for each activity either in the project proposal form or in a draft document that you are working on. When you examine the notes you take for each activity, you will notice that some of the resources, equipment or services required for the activities may be shared or included in the same budget item. For example, if you foresee the design and distribution of brochures in your two different activities, you should specify them in a single budget item, not separately. On the other hand, if two different training services are foreseen for two different activities, you can specify that you will purchase two different training services under the 6. Other. In this case, you will need to number, name, budget and justify the different education service purchases such as 6.1, 6.2. However, if the same type of training is foreseen in both activities, then it would be beneficial to enter a single budget item under the heading 6.1.

If we examine the cost sections one by one, Human Resources takes the first place. Sections 1.1 and 1.2 are designated as the place where the wages of national or international employees will be written. In part 1.3, if any domestic or international mobility of the personnel is foreseen within the framework of your activities, it is requested to include the per diems related to this.

You can elaborate on sections 1.1 and 1.2 if necessary. For example, such as 1.1.1 Technician, 1.1.2 Psychologist, 1.1.3 Guidance Teacher, 1.1.4 English teacher… When determining and budgeting the wages of these employees, remember that these are gross. In addition to the gross wage, it is recommended to add the taxes that employers have to pay to these costs. Otherwise, your institution will have to cover these fees or the employee salaries will be lower than you set. On the other hand, you need to take into account the inflation problem seen all over the world in recent years. You need to calculate inflation for the year or years in which the project will be carried out and reflect the rate you find as a result of this calculation to your budget. For example, for a position where you set a gross wage of 1000 Euros, if you have estimated the inflation rate of 10% in the year the project will be implemented, it will be necessary to write an amount such as 1,100 Euros in the budget. It is important that you explain the reason for this redundancy in the justification section.

As mentioned, you are requested to include personnel duty allowances in section 1.3. It is recommended that you pay attention to the upper limits determined by the grant program when determining these per diems. If no cap is set, you can price the task to determine an average daily and justify that way. Remember, in this section you will only set the per diem for the attendant, for transportation you are requested to specify the costs in section 2.

In section 2, you are expected to include local and international travel. These trips must be related to the given task and project. If your project includes participation in an international meeting, you can calculate the average travel costs and add your estimated changes for inflation and budget it. You have to do these calculations for each activity one by one. Similarly, you are expected to put budget for local mobilities and meetings. On the other hand, the payments to be made for the staff to come to work should not be included in this section, but should be specified in the Human Resources section (it should be included to wages).

In the 3. Equipment and Supplies section, you can specify the fixtures, consumables, goods, machinery and tools you need to carry out the project activities. In this section, you can buy these equipments as well as rent them. Some programs do not allow or limit rentals. Unless you have an important reason, it is recommended not to rent and buy equipment. As a matter of fact, after the completion of the project, it is necessary to ensure the sustainability of the activities. Therefore, it will be easier and more sustainable to use the purchased equipment instead of finding financing again to rent the needed equipment.

On the other hand, when purchasing equipment, some grant programs may require you to set a budget equal to the depreciation rate of the product you will receive. For example, if you are going to use a computer with a depreciation of 5 years in a project of 3 years, you may be asked to write down 3/5 of the cost of this computer and justify it as such.

It is possible to make your main headings detailed as in other sections. For example, if you are going to create a training office, You can write items under 3.2 Furniture, Computer equipment part such as 3.2.1 Desk, 3.2.2 Working chair, 3.2.3 Coffee table, 3.2.4 Working chair, 3.2.5 Smart Board, 3.2.6 Computer, 3.2.7 Projection tool, 3.2.8 Cabinet, 3.2.9 Hanger, 3.2.10 Chair etc..

While budgeting, you can write your needs under the relevant section or under the headings in other sections. The important thing here is that the budget item is not stated in irrelevant parts and that it allows the independent evaluator to examine the budget in a consistent and logical framework.

In the 4th part, you can budget your project office expenses. Office rent, monthly costs of tools required to carry out the works related to the project, office supply costs are included in this section. The important thing here is to be objective and consistent when justifying these costs. The budget you will allocate for the project office rent should not be used for an office rent you normally pay. Or in a project where you have allocated an apartment of your own, if the project office is designated as a single room, you only need to include the expenses of that part in the budget. On the other hand, if you already have an office, you can specify that you will allocate this office to the project as co-financing instead of writing it down as a cost. Some grant programs also consider such co-financing as a contribution to the project budget. In projects that do not consider such in-kind supports as a contribution to the budget, these contributions are still seen as positive. For this reason, it is recommended that you budget office supplies and, if necessary, vehicle expenses, and show the parts such as office rent and payment of bills as co-financing in this section. However, this is only a recommendation. If you are well justified and the costs are determined realistically, it is possible to receive grant support for office rent and bills and similar expenses.

Part 5 covers other costs and services:

5.1 Publications: In this section, you can allocate a budget for the printing and design expenses of the books and intellectual outputs you will produce within the framework of the project. In order to create the contents of these products, you can allocate a budget in different parts in parallel with the activities of the project. On the other hand, if a detailed activity is not foreseen to create content, you can budget in this section. For example, if you have planned to design an instructor training booklet on facilitating the participation of people with disabilities in society within the scope of your project and you have allocated a human resource for this, you can only include printing and design expenses in this section. However, if you want to design and prepare a comic book series on the participation of people with disabilities in society, you can justify it in this title.

5.2 Studies, research: As mentioned in 5.1, if no research or study is foreseen to be carried out in a different activity of your project, you can cost a needs analysis or any research work in this part.

5.3 Evaluation costs: Some grant schemes require external auditor services. In such a case, you can budget the purchase of an external audit service under this heading. On the other hand, although there is no such obligation, you can allocate a budget for this service with good justification. If you are not going to purchase such a service, you can do an internal audit using the project's human resources, but it is recommended that you justify it well in the project.

5.4 Translation, interpreters: If your project requires translation or interpreter services, you can put a cost in this section. On the other hand, if your human resources in the project have the knowledge, skills and equipment to do these works, you can state that you will benefit from these resources in the project proposal and you may not allocate a budget for this part.

5.5 Financial services (bank guarantee costs etc.): Some programs may require a bank guarantee letter from the grant beneficiary. In addition, bank transfer expenses and costs arising from exchange rate changes may arise. If the grant program allows these to be met, you can specify an estimated budget in this section.

5.6 Costs of conferences/seminars: If you are going to organize seminars and conferences, you can include the relevant costs in this section. It is important that you detail the costs of each seminar and conference in headings. For example, under the heading of 5.6.3 Project Closing Conference, 5.6.3.1 Catering expenses, 5.6.3.2 Conference hall rental fee, 5.6.3.3 Key Note Speaker Cost, 5.6.3.4 Simultaneous Interpreter and Equipment Expenses.

5.7 Visibility actions: In this section, you can create budget items for your visibility, promotion and dissemination activities that you plan to carry out within the scope of the project and/or the materials you will use in your activities.

6.Other

You can put budget of the products and services that are not included in the other sections under this heading. Generally, project-specific service procurements are included under this heading. For example, you can specify a limited-time training, guidance or consultancy service under this heading.

7. Section 7 contains the sum of the subtotals of all your activities.

8. Indirect costs, in this example, can be up to 7% of your direct expenses (i.e. the total amount included in Section 7.). In different programs, the rate of indirect expenses may vary, in some of them this budget item may not be exist.

9. In the 9th part, the sum of the costs in the 7th and 8th parts is given.

10. In this example, the sum of all the activities in section 7 can be reserved for a maximum of 5% of the direct expenditures. In different programs, this rate may change, in some this budget item may not be exist.

11. Total costs in sections 9 and 10 will give the total budget of the project. These costs include the subtotals of the parts in the project budget (direct expenses), indirect expenses (maximum 7% of direct expenses), reserve funds (maximum 5% of direct expenses).

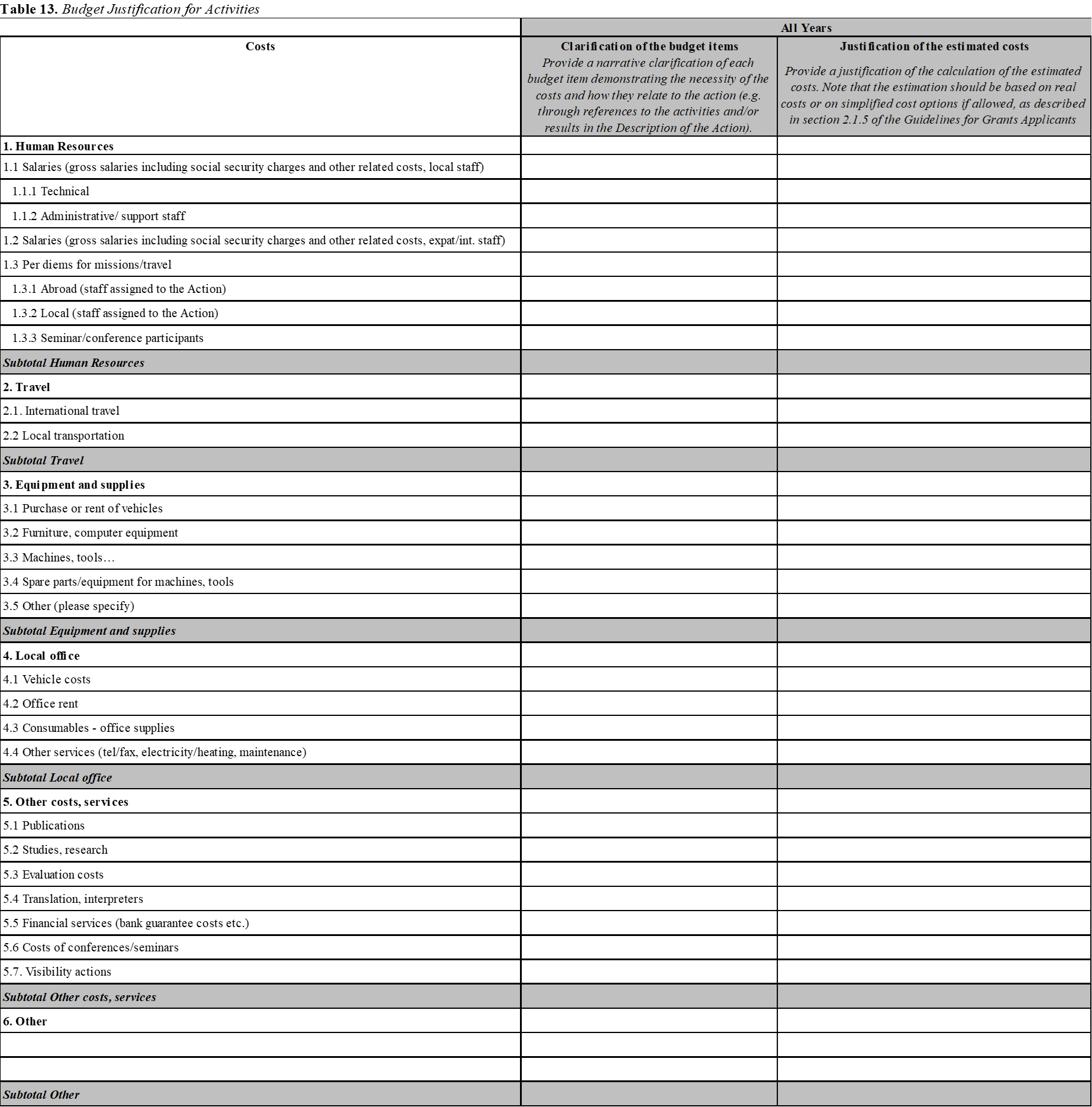

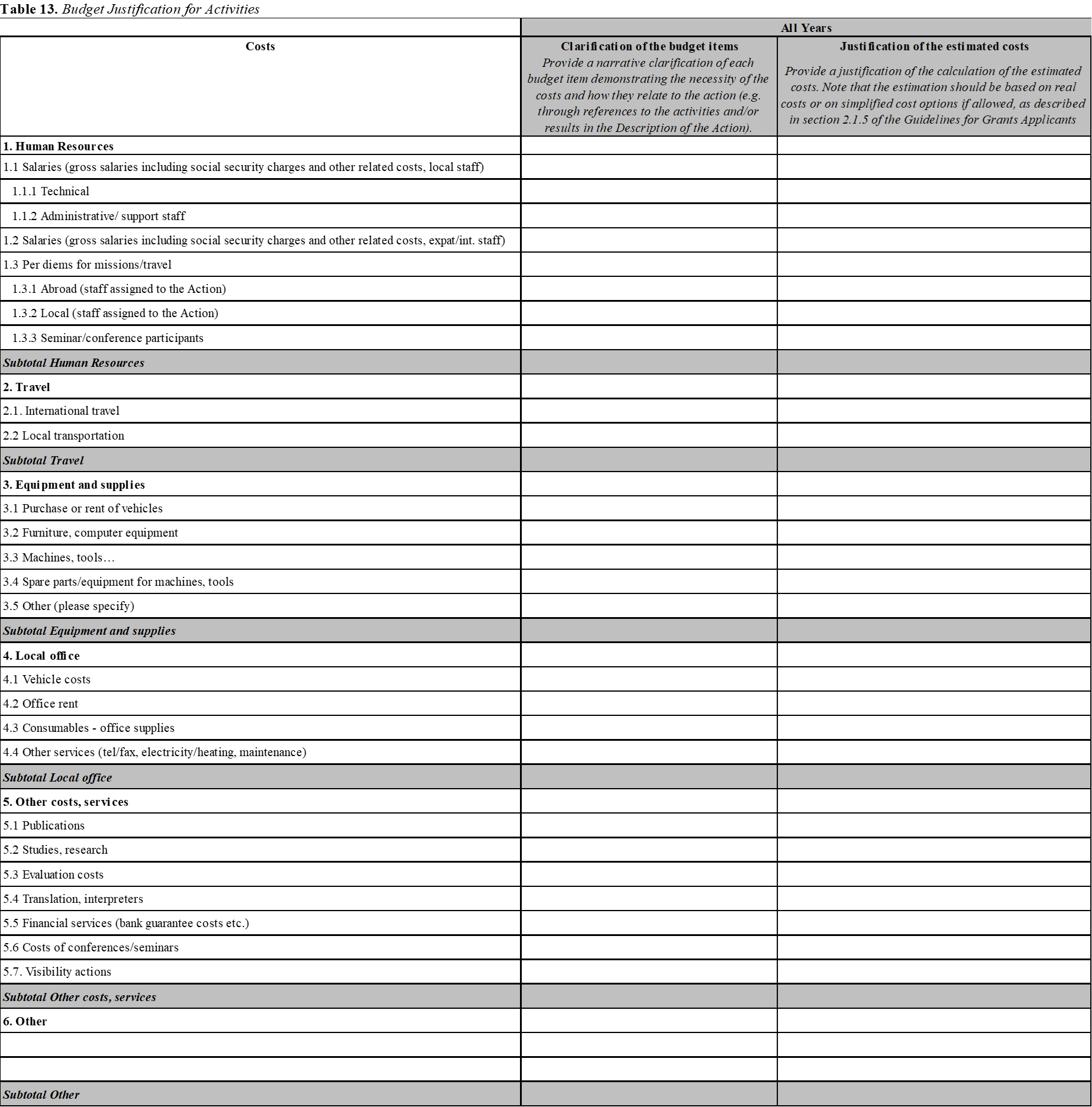

You are expected to justify and explain the budget items and their costs that you have identified in the 2. Justification of the Budget for the Action section.